Forum

Warto wiedzieć

Twoje Forum

Forum Giełda

+Dodaj wątek

Opublikowano przy kursie:

3,05 zł

, zmiana od tamtej pory:

-12,13%

Info

Zgłoś do moderatoraSimplus Wall info:

Last Price PLN 3.05

Fair Value Select

New major risk - Financial position

The company has less than a year of cash runway based on its current free cash flow trend.

Free cash flow: -zł9.0m

This is considered a major risk. With less than a year's worth of cash, the company will need to raise capital or take on deb. unless its cash flows improve. This would dilute existing shareholders or increase balance sheet risk.

Currently, the following risks have been identified for the company:

Major Risks

Less than 1 year of cash runway based on free cash flow trend (-zł9.0m free cash flow).

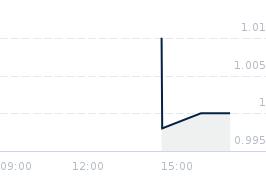

Share price has been highly volatile over the past 3 months (12% average weekly change).

Earnings have declined by 9.4% per year over the past 5 years.

Shareholders have been substantially diluted in the past year (40% increase in shares outstanding).

Reven is less than US$1m (zł724k reven, or US$178k).

Last Price PLN 3.05

Fair Value Select

New major risk - Financial position

The company has less than a year of cash runway based on its current free cash flow trend.

Free cash flow: -zł9.0m

This is considered a major risk. With less than a year's worth of cash, the company will need to raise capital or take on deb. unless its cash flows improve. This would dilute existing shareholders or increase balance sheet risk.

Currently, the following risks have been identified for the company:

Major Risks

Less than 1 year of cash runway based on free cash flow trend (-zł9.0m free cash flow).

Share price has been highly volatile over the past 3 months (12% average weekly change).

Earnings have declined by 9.4% per year over the past 5 years.

Shareholders have been substantially diluted in the past year (40% increase in shares outstanding).

Reven is less than US$1m (zł724k reven, or US$178k).

- Kurs Euro

- Kurs dolar

- Kurs frank

- Kurs funt

- Wiron

- Przelicznik walut

- Kantor internetowy

- Kalkulator wynagrodzeń

- Umowa zlecenie

- Kredyt na mieszkanie

- Kredyt na samochód

- Kalkulator kredytowy

- Revolut

- Winiety

- Jak grać na giełdzie?

- Jak wziąć kredyt hipoteczny?

- Rejestracja samochodu

- Jak rozwiązać umowę z Orange

- Koszty uzyskania przychodów

- Sesje elixir

- PB weekend

- RRSO co to jest?

- Blogbank.pl

- Promocje bankowe - zgarnijpremie.pl

- Stopa procentowa