Forum

Warto wiedzieć

Twoje Forum

Forum Giełda

+Dodaj wątek

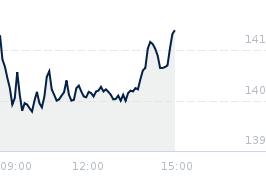

Opublikowano przy kursie:

66,00 zł

, zmiana od tamtej pory:

196,82%

$$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

Zgłoś do moderatoraChina’s long-term copper deals bring much-needed cash to miners along new Silk Road

Prevailing spot premiums, and treatment and refining charges for China-bound cathodes and concentrates suggest selling copper to the world’s largest user of the metal is proving difficult this year. It is not only the slump in Shanghai premiums or the jump in TC/RCs this year that are causing concern: a rise in bonded stocks and an eyebrow-raising surge in exports from China in May have also reinforced impressions that China has all the copper it needs. But focusing too much on the spot market can sometimes leave market participants with a myopic view of China’s raw materials demand, and there is a common refrain among producers that, however dull or exciting the spot market is, it is long-term business that matters. As Freeport’s Javier Targhetta put it some time back: "The spot market is always quite a seexy thing to talk about because of the absolutely extreme swings it has ... but when we get into serious negotiations what we discuss is the supply and demand balance, and stable market conditions." Targhetta’s point is worth revisiting, because in serious negotiations, China is clearly still willing to pay big money to secure long-term supplies of copper. The sale of Freeport’s Tenke mine to China Molybdenum provided clear evidence of that; and this week, China’s quest to secure copper continued, this time to the benefit of rival miners KGHM and Eurasian Resources Group. Following a renewal of its long-term partnership with Minmetals on Monday, KGHM is set to sell as much as $2.85 billion worth of copper cathode into China between 2017 and 2021, while ERG will sell at least 175,000 dry metric tonnes of concentrate from the Frontier mine in the Democratic Republic of Congo to China Nonferrous Metals Corp annually on an ongoing basis. CNMC, the owner of the Chambishi Copper Smelter, will welcome a secure supply of concentrates following a string of mine closures in the Copperbelt; for Minmetals, the supply agreement with KGHM adds to its clout as a major supplier to domestic copper consumers and to the Chinese state. For KGHM and ERG, meanwhile, locking in long-term sales agreements will allow them to focus on the core business of mining copper as efficiently as possible during a period of sustained price weakness. For outside observers, the deals also give shape to the structure of investments being undertaken by the Chinese state as part of the New Silk Road initiative. So far, the industry’s attention has been largely focused on the potential downstream demand uplift that may arise from investment in infrastructure along the Maritime Silk Road and the Silk Road Economic Belt, which will eventually span a vast tract of land and sea running from the Island of Papua to the port of Rotterdam, if all goes to plan. But in the immediate term, it looks as though China’s focus will be on ensuring that its own companies are the ones supplying the raw materials for the massive infrastructural overhaul it has sketched out. With spot premiums falling, TC/RCs rising, and outright prices stuck doggedly below $5,000 per tonne, miners will welcome that order of investment with a sigh of relief.

The cathode market is long – KME

While the scrap market is tight, there is currently a plentiful supply of copper cathode in the European market, Marco Calamia, the head of metals at KME, told delegates at the fifth Metal Bulletin Copper Recycling conference in Munich. Scrap supply in western Europe is being crimped by a combination of factors including lower and less volatile outright copper prices, increased toll processing, weak industrial activity and rising consumption of scrap in eastern Europe, which used to be a major supplier to western scrap consumers, Calamia told delegates in Munich on Thursday June 16. However, regional cathode availability has loosened this year, due to strong treatment and refining charges, a slump in exports to China and a simultaneous rise in imports of non-grade A cathode from suppliers in Russia and Africa. The Metal Bulletin Copper Concentrates Index was calculated at $97.50 per dry metric tonne and 9.75 cents per lb. "I consume 500,000 tonnes of copper a year so I have some feeling about the cathode market, and I feel the market is long at the moment; there is good availability," Calamia said. KME is a major consumer of both high-grade scrap and copper cathode, and Calamia noted that, from a commercial viewpoint, there are benefits and drawbacks to both input materials. Because scrap is priced at a discounnt to the LME, increasing the use of scrap also helps to increase margins, but consumers must contend with much greater volatility in pricing and availability, as well as increased handling and admin costs and a more significant supply risk, he said. Scrap is typically supplied with payment terms, whereas cathode is generally paid for on release, he said, although this is starting to change, he also noted. As mining companies’ finances have deteriorated in the past few years, they have established closer relationships with merchants who are willing to provide cash upfront to secure long-term supply, he said. "Producers are financially weaker and now they are looking at a different way of working, so they look for liquidity … They want pre-payment or they sell one year in advance," he said. "So now traders are enlarging their position between producer and consumer, because they have liquidity and they can provide it to both sides of the market. Traders can offer financial support to the final customer, offering similar terms of payment," Calamia said.

Buy recommendations for Freeport, Rio, First Quantum after Brexit - Jefferies

Jefferies has issued renewed buy recommendations for certain copper mining stocks in the wake of the UK’s vote in favour of leaving the EU. Toronto-listed First Quantum Minerals, London- and New York-listed Rio Tinto, and New York-listed Freeport McMoRan were all given the recommendations on Monday June 27. There is a possibility that demand for mined commodities could strengthen as a result of Brexit, Chris LaFemina said in a note, which may in turn be supportive for these equities. "While Brexit clearly increases the risk to global growth, the direct impact on demand for mined commodities should be limited," LaFemina said. "If Central Bank policy becomes more accommodative in response to Brexit, demand for mined commodities could actually strengthen. Currency risk and macro risk are obvious issues but our analysis indicates that a sharp sell-off in most mining equities would be unwarranted." Jefferies has now put out a price target on the Toronto exchange for First Quantum of C$12.50 ($9.61) per share. The company’s shares closed at C$8.85 on Friday June 24, down 9.97% from the previous day. "First Quantum is poised to deliver strong [free cash flow] and [earnings] growth as a result of industry-leading volume growth in copper, low unit costs, and an expected recovery in the copper price in 2018-19. The company has [also] strengthened its balance sheet," LaFemina said. For Rio Tinto, Jefferies gave a target of $33. On the New York Stock Exchange, its American depository receipts were trading at $28.76, down 7.46%. "We reiterate our positive outlook for Rio Tinto shares for a variety of reasons, including the company’s high-quality assets, relatively low operating risk, strong free cash flow through the cycle, strong balance sheet, and inexpensive equity valuation," LaFemina said. Freeport-McMoRan, meanwhile, was given a price target of $15 on the NYSE. Its share price was down 10.11% as of 12:40 BST on Monday, at $10.58. "Based on our analysis, Freeport’s share price is likely to [climb] higher [because of] a combination of accretive asset sales, strong free cash flow in [the second half of 2016] and 2017 because of volume growth, lower costs and capex, and longer-term upside to the copper price," LaFemina added.

Brexit – Where now for Britain's financial sector?

Britain has just taken a great leap into the unknown, taking its financial sector with it.

Britain’s vote to leave the EU after over 40 years defied pollsters and stunned financial markets, which had priced in the likelihood of a vote to stay. In an extraordinary few hours, British Prime Minister David Cameron has announced plans to resign and Scotland’s first minister Nicola Sturgeon has said another referendum on Scottish independence is back on the table. Now Britain and the rest of the world are facing the task of working out what exactly the vote to leave will mean, including for its cleared derivatives markets, exchanges and regulators. Little is clear right now. The impact on Britain’s banking sector and the country’s position as a global financial hub will be key. Britain’s financial sector assets account for more than eight times its gross domestic product, analysts estimate, meaning that the global contagion effect given its links with the EU could be huge, in the short-term at least. According to the International Monetary Fund, around a third of Britain’s financial and insurancce services exports are to the EU, more than half of its banking sector’s cross-border lending is directed to the EU, and almost half of its foreign direct investment comes from the EU.

Banks

Key to Britain’s success as a global financial hub is the existence of a system known as passporting, which provides the right to sell services across the 28 nations of the EU without having to get regulatory approval in each individual country.

Prior to the vote to leave the EU, finance ministers across Europe said that this system would end at worst or be required to be renegotiated with reciprocal concessions at best. Ratings agency Fitch Ratings has warned this morning that Britain’s status as a major international banking hub could be damaged as some business lines shift to the EU. HSBC and Goldman Sachs had previously said they would have to move some operations – and thousands of joobs – out of Britain in the event of a vote to leave the EU. Whether or not the banks take this action when it comes down to it remains to be seen. But the lack of clarity on Britain’s trading structure and the passporting system is already creating uncertainty among employees at major banks in London.

There are already media reports that Morgan Stanley has established a task force to look at moving 2,000 London-based investment banking staff out of London, with Frankfurt or Dublin possible target destinations. The ceo of JP Morgan, which has 16,000 employees in Britain, said this morning that the bank "may need to make changes to our European legal entity structure and the location of some roles". "While these changes are not certain, we have to be prepared to comply with new laws as we serve our clients around the world. We will always do our best to take care of our people and do the right thing during times of change," the bank’s Jamie Dimon said. US investment bank Goldman Sachs, meanwhile, said it has been focused on planning for either referendum outcome for many months. There have been media reports that the bank has been working out which joobs might be affected by the potential loss of passporting and where else in the EU it has banking licences – such as Germany – as well as infrastructure that it can quickly ramp up. "Goldman Sachs has a long history of adapting to change, and we will work with relevant authorities as the terms of the exit become clear. Our primary focus, as always, remains serving our clients’ needs," its chairman and ceo Lloyd Blankfein said in a statement. Britain is not likely to see its financial sector vanish overnight – the benefits of its time zone, language, and legal system are not going anywhere. The role of banks in commodities has already been changing for some time. The withdrawal of the banking community from the commodities market amid heavy regulation and a downturn in the asset class, along with its negative impact on liquidity, has been well-documented. But at times when banks take decisions to cut staff, their commodities businesses are often the first to go.

Regulation

Like them or not, there are numerous EU laws and regulations that assist the functioning of the derivatives markets.

Commodities market participants have just grown used to the European Market Infrastructure Regulation (EMIR), which imposes requirements on central counterparties and clearing members as well as reporting requirements in respect of exchange-traded derivatives. As the FIA clearly notes in a report commissioned on Brexit, the global nature of the derivatives markets means that much of this regulation relies on cross-border recognition, both within the EU and increasingly globally. The efficient functioning of key financial market infrastructure, such as central counterparties and trade repositories, also relies on EU and global recognition agreements. Existing regulation is expected to remain in place until the post-Brexit regime has been negotiated. The Financial Conduct Authority said that much financial regulation in Britain is derived from the EU. "This legislation remains applicable until any changes are made, which will be a matter for government and parliament," it noted. "The longer term impacts of the decision to leave the EU on the overall regulatory framework for the UK will depend, in part, on the relationship that the UK seeks with the EU in future. We will work closely with the government as it confirms the arrangements for the UK’s future relationship with the EU," it added. It is probable that the regulatory authorities in the EU would want to retain some form of oversight over the trading of derivatives and currencies, and push to have contracts cleared within the trading bloc as a result. "One long-term effect of a Brexit is likely to be that, notwithstanding global initiatives to which it is likely to remain a party, the U.K. regulatory rules impacting derivatives counterparties start to diverge from the equivalent EU rules," the FIA report said. "This would effectively leave those counterparties with cross-border operations with a dual compliance burden – to the extent that they were still required to comply with EU regulation in order to continue to trade with the EU, for example, as is very likely to be the case under EMIR," it added. Key pieces of regulatory legislation will now need to be negotiated, including passporting, financial collateral, netting and set-off arrangements, cross-border recognition provisions under EMIR, and cross-border access to trading venues, clearing and settelement systems under the pending Markets in Financial Instruments Directive II (MiFID II) and the Markets in Financial Instruments Regulation (MiFIR). Much of this could be done via establishing equivalents, allowing non-EU companies to do business across the EU if they are based in a country that has adequate legal and supervisory arrangements. Much also depends on the willingness of regulators and politicians to do this. In all likelihood, nobody wants to see financial chaos in a globally-connected world. Exchanges have been closely watching events. London Metal Exchange spokeswoman Miriam Heywood said that in advance of the referendum, the exchange carried out impact assessments on the LME and LME Clear and was confident that its systems and processes are robust and will ensure the continuance of a fair and orderly market. "While we anticipated that there might be increased volatility both during and following the outcome of the vote, we do not envisage any major impact on our markets," she said. "We are unable to comment on any potential changes to legislation or policy until the relevant authorities have issued their respective guidance," she added.

Credit ratings & costs

Corporates will now be examining the potential effect of a UK or individual company credit downgrade.

Fitch Ratings has already said that the leave result is credit negative for most sectors in Britain due to the weaker medium-term growth and investment prospects and uncertainty about future trade arrangements, and that it will review the sovereign rating shortly. According to the FIA report, changes to credit ratings will hit the creditworthiness of some counterparties and increase the cost of doing business. "Many derivatives contracts are entered into by UK entities, or entities with significant UK exposures, who could find that their credit rating, or others’ opinion of their creditworthiness, is negatively affected," the FIA report said. "Consequently, it may be more expensive for affected parties to enter into new derivatives transactions and to manage existing positions - for example, collateralisation requirements may increase. Porting or termination rights may also be triggered to the extent that certain counterparties are particularly adversely affected," the FIA report added. There are still too many unknowns at this stage about what a Brexit will definitively mean and how it might change Britain’s financial markets. All that is certain is that there’s plenty of work to be done.

źródło: metalbulletin.com

Prevailing spot premiums, and treatment and refining charges for China-bound cathodes and concentrates suggest selling copper to the world’s largest user of the metal is proving difficult this year. It is not only the slump in Shanghai premiums or the jump in TC/RCs this year that are causing concern: a rise in bonded stocks and an eyebrow-raising surge in exports from China in May have also reinforced impressions that China has all the copper it needs. But focusing too much on the spot market can sometimes leave market participants with a myopic view of China’s raw materials demand, and there is a common refrain among producers that, however dull or exciting the spot market is, it is long-term business that matters. As Freeport’s Javier Targhetta put it some time back: "The spot market is always quite a seexy thing to talk about because of the absolutely extreme swings it has ... but when we get into serious negotiations what we discuss is the supply and demand balance, and stable market conditions." Targhetta’s point is worth revisiting, because in serious negotiations, China is clearly still willing to pay big money to secure long-term supplies of copper. The sale of Freeport’s Tenke mine to China Molybdenum provided clear evidence of that; and this week, China’s quest to secure copper continued, this time to the benefit of rival miners KGHM and Eurasian Resources Group. Following a renewal of its long-term partnership with Minmetals on Monday, KGHM is set to sell as much as $2.85 billion worth of copper cathode into China between 2017 and 2021, while ERG will sell at least 175,000 dry metric tonnes of concentrate from the Frontier mine in the Democratic Republic of Congo to China Nonferrous Metals Corp annually on an ongoing basis. CNMC, the owner of the Chambishi Copper Smelter, will welcome a secure supply of concentrates following a string of mine closures in the Copperbelt; for Minmetals, the supply agreement with KGHM adds to its clout as a major supplier to domestic copper consumers and to the Chinese state. For KGHM and ERG, meanwhile, locking in long-term sales agreements will allow them to focus on the core business of mining copper as efficiently as possible during a period of sustained price weakness. For outside observers, the deals also give shape to the structure of investments being undertaken by the Chinese state as part of the New Silk Road initiative. So far, the industry’s attention has been largely focused on the potential downstream demand uplift that may arise from investment in infrastructure along the Maritime Silk Road and the Silk Road Economic Belt, which will eventually span a vast tract of land and sea running from the Island of Papua to the port of Rotterdam, if all goes to plan. But in the immediate term, it looks as though China’s focus will be on ensuring that its own companies are the ones supplying the raw materials for the massive infrastructural overhaul it has sketched out. With spot premiums falling, TC/RCs rising, and outright prices stuck doggedly below $5,000 per tonne, miners will welcome that order of investment with a sigh of relief.

The cathode market is long – KME

While the scrap market is tight, there is currently a plentiful supply of copper cathode in the European market, Marco Calamia, the head of metals at KME, told delegates at the fifth Metal Bulletin Copper Recycling conference in Munich. Scrap supply in western Europe is being crimped by a combination of factors including lower and less volatile outright copper prices, increased toll processing, weak industrial activity and rising consumption of scrap in eastern Europe, which used to be a major supplier to western scrap consumers, Calamia told delegates in Munich on Thursday June 16. However, regional cathode availability has loosened this year, due to strong treatment and refining charges, a slump in exports to China and a simultaneous rise in imports of non-grade A cathode from suppliers in Russia and Africa. The Metal Bulletin Copper Concentrates Index was calculated at $97.50 per dry metric tonne and 9.75 cents per lb. "I consume 500,000 tonnes of copper a year so I have some feeling about the cathode market, and I feel the market is long at the moment; there is good availability," Calamia said. KME is a major consumer of both high-grade scrap and copper cathode, and Calamia noted that, from a commercial viewpoint, there are benefits and drawbacks to both input materials. Because scrap is priced at a discounnt to the LME, increasing the use of scrap also helps to increase margins, but consumers must contend with much greater volatility in pricing and availability, as well as increased handling and admin costs and a more significant supply risk, he said. Scrap is typically supplied with payment terms, whereas cathode is generally paid for on release, he said, although this is starting to change, he also noted. As mining companies’ finances have deteriorated in the past few years, they have established closer relationships with merchants who are willing to provide cash upfront to secure long-term supply, he said. "Producers are financially weaker and now they are looking at a different way of working, so they look for liquidity … They want pre-payment or they sell one year in advance," he said. "So now traders are enlarging their position between producer and consumer, because they have liquidity and they can provide it to both sides of the market. Traders can offer financial support to the final customer, offering similar terms of payment," Calamia said.

Buy recommendations for Freeport, Rio, First Quantum after Brexit - Jefferies

Jefferies has issued renewed buy recommendations for certain copper mining stocks in the wake of the UK’s vote in favour of leaving the EU. Toronto-listed First Quantum Minerals, London- and New York-listed Rio Tinto, and New York-listed Freeport McMoRan were all given the recommendations on Monday June 27. There is a possibility that demand for mined commodities could strengthen as a result of Brexit, Chris LaFemina said in a note, which may in turn be supportive for these equities. "While Brexit clearly increases the risk to global growth, the direct impact on demand for mined commodities should be limited," LaFemina said. "If Central Bank policy becomes more accommodative in response to Brexit, demand for mined commodities could actually strengthen. Currency risk and macro risk are obvious issues but our analysis indicates that a sharp sell-off in most mining equities would be unwarranted." Jefferies has now put out a price target on the Toronto exchange for First Quantum of C$12.50 ($9.61) per share. The company’s shares closed at C$8.85 on Friday June 24, down 9.97% from the previous day. "First Quantum is poised to deliver strong [free cash flow] and [earnings] growth as a result of industry-leading volume growth in copper, low unit costs, and an expected recovery in the copper price in 2018-19. The company has [also] strengthened its balance sheet," LaFemina said. For Rio Tinto, Jefferies gave a target of $33. On the New York Stock Exchange, its American depository receipts were trading at $28.76, down 7.46%. "We reiterate our positive outlook for Rio Tinto shares for a variety of reasons, including the company’s high-quality assets, relatively low operating risk, strong free cash flow through the cycle, strong balance sheet, and inexpensive equity valuation," LaFemina said. Freeport-McMoRan, meanwhile, was given a price target of $15 on the NYSE. Its share price was down 10.11% as of 12:40 BST on Monday, at $10.58. "Based on our analysis, Freeport’s share price is likely to [climb] higher [because of] a combination of accretive asset sales, strong free cash flow in [the second half of 2016] and 2017 because of volume growth, lower costs and capex, and longer-term upside to the copper price," LaFemina added.

Brexit – Where now for Britain's financial sector?

Britain has just taken a great leap into the unknown, taking its financial sector with it.

Britain’s vote to leave the EU after over 40 years defied pollsters and stunned financial markets, which had priced in the likelihood of a vote to stay. In an extraordinary few hours, British Prime Minister David Cameron has announced plans to resign and Scotland’s first minister Nicola Sturgeon has said another referendum on Scottish independence is back on the table. Now Britain and the rest of the world are facing the task of working out what exactly the vote to leave will mean, including for its cleared derivatives markets, exchanges and regulators. Little is clear right now. The impact on Britain’s banking sector and the country’s position as a global financial hub will be key. Britain’s financial sector assets account for more than eight times its gross domestic product, analysts estimate, meaning that the global contagion effect given its links with the EU could be huge, in the short-term at least. According to the International Monetary Fund, around a third of Britain’s financial and insurancce services exports are to the EU, more than half of its banking sector’s cross-border lending is directed to the EU, and almost half of its foreign direct investment comes from the EU.

Banks

Key to Britain’s success as a global financial hub is the existence of a system known as passporting, which provides the right to sell services across the 28 nations of the EU without having to get regulatory approval in each individual country.

Prior to the vote to leave the EU, finance ministers across Europe said that this system would end at worst or be required to be renegotiated with reciprocal concessions at best. Ratings agency Fitch Ratings has warned this morning that Britain’s status as a major international banking hub could be damaged as some business lines shift to the EU. HSBC and Goldman Sachs had previously said they would have to move some operations – and thousands of joobs – out of Britain in the event of a vote to leave the EU. Whether or not the banks take this action when it comes down to it remains to be seen. But the lack of clarity on Britain’s trading structure and the passporting system is already creating uncertainty among employees at major banks in London.

There are already media reports that Morgan Stanley has established a task force to look at moving 2,000 London-based investment banking staff out of London, with Frankfurt or Dublin possible target destinations. The ceo of JP Morgan, which has 16,000 employees in Britain, said this morning that the bank "may need to make changes to our European legal entity structure and the location of some roles". "While these changes are not certain, we have to be prepared to comply with new laws as we serve our clients around the world. We will always do our best to take care of our people and do the right thing during times of change," the bank’s Jamie Dimon said. US investment bank Goldman Sachs, meanwhile, said it has been focused on planning for either referendum outcome for many months. There have been media reports that the bank has been working out which joobs might be affected by the potential loss of passporting and where else in the EU it has banking licences – such as Germany – as well as infrastructure that it can quickly ramp up. "Goldman Sachs has a long history of adapting to change, and we will work with relevant authorities as the terms of the exit become clear. Our primary focus, as always, remains serving our clients’ needs," its chairman and ceo Lloyd Blankfein said in a statement. Britain is not likely to see its financial sector vanish overnight – the benefits of its time zone, language, and legal system are not going anywhere. The role of banks in commodities has already been changing for some time. The withdrawal of the banking community from the commodities market amid heavy regulation and a downturn in the asset class, along with its negative impact on liquidity, has been well-documented. But at times when banks take decisions to cut staff, their commodities businesses are often the first to go.

Regulation

Like them or not, there are numerous EU laws and regulations that assist the functioning of the derivatives markets.

Commodities market participants have just grown used to the European Market Infrastructure Regulation (EMIR), which imposes requirements on central counterparties and clearing members as well as reporting requirements in respect of exchange-traded derivatives. As the FIA clearly notes in a report commissioned on Brexit, the global nature of the derivatives markets means that much of this regulation relies on cross-border recognition, both within the EU and increasingly globally. The efficient functioning of key financial market infrastructure, such as central counterparties and trade repositories, also relies on EU and global recognition agreements. Existing regulation is expected to remain in place until the post-Brexit regime has been negotiated. The Financial Conduct Authority said that much financial regulation in Britain is derived from the EU. "This legislation remains applicable until any changes are made, which will be a matter for government and parliament," it noted. "The longer term impacts of the decision to leave the EU on the overall regulatory framework for the UK will depend, in part, on the relationship that the UK seeks with the EU in future. We will work closely with the government as it confirms the arrangements for the UK’s future relationship with the EU," it added. It is probable that the regulatory authorities in the EU would want to retain some form of oversight over the trading of derivatives and currencies, and push to have contracts cleared within the trading bloc as a result. "One long-term effect of a Brexit is likely to be that, notwithstanding global initiatives to which it is likely to remain a party, the U.K. regulatory rules impacting derivatives counterparties start to diverge from the equivalent EU rules," the FIA report said. "This would effectively leave those counterparties with cross-border operations with a dual compliance burden – to the extent that they were still required to comply with EU regulation in order to continue to trade with the EU, for example, as is very likely to be the case under EMIR," it added. Key pieces of regulatory legislation will now need to be negotiated, including passporting, financial collateral, netting and set-off arrangements, cross-border recognition provisions under EMIR, and cross-border access to trading venues, clearing and settelement systems under the pending Markets in Financial Instruments Directive II (MiFID II) and the Markets in Financial Instruments Regulation (MiFIR). Much of this could be done via establishing equivalents, allowing non-EU companies to do business across the EU if they are based in a country that has adequate legal and supervisory arrangements. Much also depends on the willingness of regulators and politicians to do this. In all likelihood, nobody wants to see financial chaos in a globally-connected world. Exchanges have been closely watching events. London Metal Exchange spokeswoman Miriam Heywood said that in advance of the referendum, the exchange carried out impact assessments on the LME and LME Clear and was confident that its systems and processes are robust and will ensure the continuance of a fair and orderly market. "While we anticipated that there might be increased volatility both during and following the outcome of the vote, we do not envisage any major impact on our markets," she said. "We are unable to comment on any potential changes to legislation or policy until the relevant authorities have issued their respective guidance," she added.

Credit ratings & costs

Corporates will now be examining the potential effect of a UK or individual company credit downgrade.

Fitch Ratings has already said that the leave result is credit negative for most sectors in Britain due to the weaker medium-term growth and investment prospects and uncertainty about future trade arrangements, and that it will review the sovereign rating shortly. According to the FIA report, changes to credit ratings will hit the creditworthiness of some counterparties and increase the cost of doing business. "Many derivatives contracts are entered into by UK entities, or entities with significant UK exposures, who could find that their credit rating, or others’ opinion of their creditworthiness, is negatively affected," the FIA report said. "Consequently, it may be more expensive for affected parties to enter into new derivatives transactions and to manage existing positions - for example, collateralisation requirements may increase. Porting or termination rights may also be triggered to the extent that certain counterparties are particularly adversely affected," the FIA report added. There are still too many unknowns at this stage about what a Brexit will definitively mean and how it might change Britain’s financial markets. All that is certain is that there’s plenty of work to be done.

źródło: metalbulletin.com

- $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Re: $$$$ PACZKA FUNDAMENTALNYCH INFORMACJI $$$$

- Kurs Euro

- Kurs dolar

- Kurs frank

- Kurs funt

- Wiron

- Przelicznik walut

- Kantor internetowy

- Kalkulator wynagrodzeń

- Umowa zlecenie

- Kredyt na mieszkanie

- Kredyt na samochód

- Kalkulator kredytowy

- Revolut

- Winiety

- Jak grać na giełdzie?

- Jak wziąć kredyt hipoteczny?

- Rejestracja samochodu

- Jak rozwiązać umowę z Orange

- Koszty uzyskania przychodów

- Sesje elixir

- PB weekend

- RRSO co to jest?

- Blogbank.pl

- Promocje bankowe - zgarnijpremie.pl

- Stopa procentowa